I often hear this question from a veteran who does not know the rules pertaining to VA unemployability income limits:

“I would apply for TDIU benefits, but don’t want to stop earning an income.”

Veterans, like anyone else in American society, really just want the opportunity to work – to thrive – in American society. The VA’s TDIU benefit exists to help the veteran who is unable to participate in substantially gainful activity due to his or her service-connected disabilities. We’ll talk more about the term “substantially gainful activity” in other posts – in this post, I want to focus on some exceptions to the VA unemployability income limits.

But first, to find out what you can recover when you receive TDIU – the formal name for the VA unemployability benefit – you need only look at what a veteran with your family size will receive with a 100% disability rating.

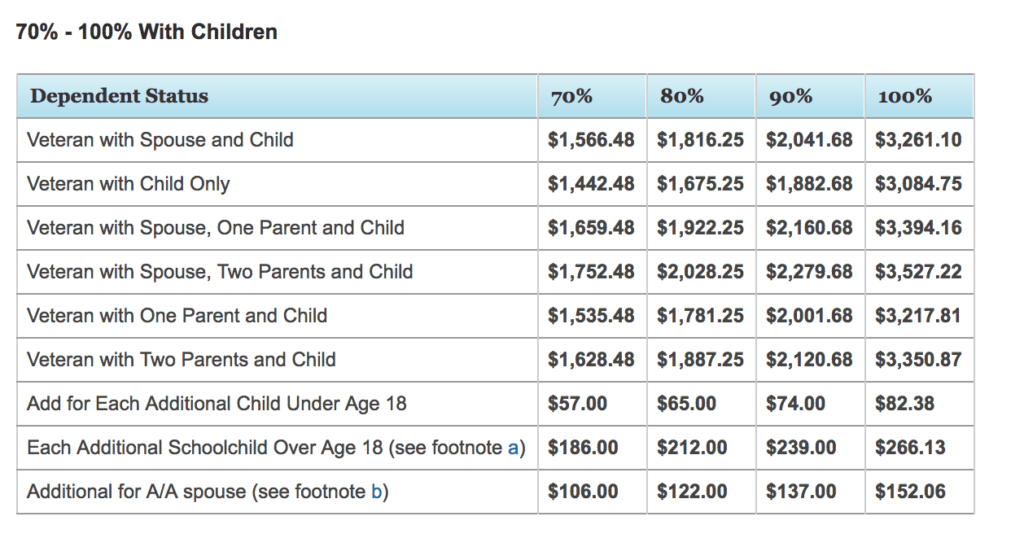

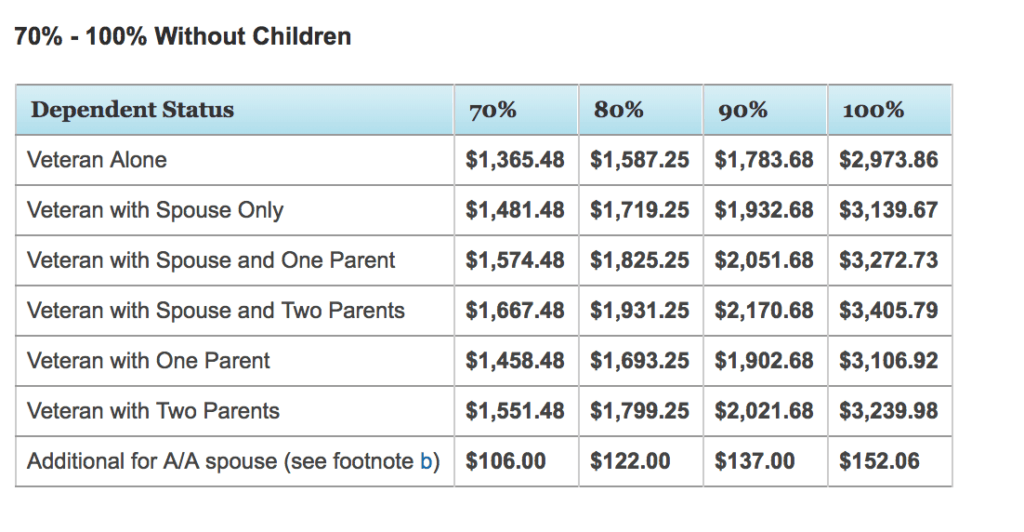

Here are the VA Disability Ratings Tables showing the amounts the VA pays for 100% disability in 2018 – first without children, then with children:

Those numbers seem big – but when compared with what many of us made in the military, they are not altogether unreasonable.

What these charts do not tell us, however, is what the VA unemployability income limits are – or, said another way, whether you earn too much money to be eligible for VA TDIU.

Let’s say you are working at a low paying job – maybe a greeter at Walmart earning $11 per hour – because that is the only employer you can find who will pay you to work with your service connected knee disability or PTSD.

The problem is that rate of pay – about $23,000 per year if you work full-time, year round – does not provide a sustainable income if you are trying to raise a family with a wife and 3 kids.

Here’s another scenario – you are earning the TDIU rate listed above and have a husband and 1 child. Your 2018 100% rate for TDIU is $3,261 per year. Again, this is just not enough in most parts of the US to raise and support your family.

Let’s say you use that Walmart greeter job to supplement your income and still make that $11/hr. This would make a HUGE impact on your family’s lifestyle and your children’s health and education even if you were to work only part time.

Many veterans will not take that job, though, because they are told that they would exceed the VA unemployability income limits and lose their TDIU benefits.

In fact, veterans are often coached (sometimes by other veterans, the VA, or a VSO) that they cannot earn an income while receiving TDIU.

This is simply not true: there is no set number that defines the VA unemployability income limits. To learn more about that, you will want to read up on the concept of VA unemployability substantially gainful activity.

Today, however, I want to talk to about the concept of sheltered – or marginal – employability and how it relates to your ability to continue to receive TDIU and stay within the VA unemployability income limits.

Bottom line, in many situations, veterans CAN continue to earn an income while receiving VA unemployability.

How can a veteran earn an income and stay within VA Unemployability Income Limits?

To answer this question, we need only look to the law.

For those of you that don’t know what TDIU is, I encourage you to read this post to get a basic understanding of the 2 types of TDIU Benefits. To those of you trying to win your VA TDIU Claim, I encourage you to consider whether a copy of the VA TDIU Field Manual, or the VA TDIU eBook Package – will help you understand and improve your VA TDIU Claims.

38 C.F.R. §4.16(a) – the section of the Code of Federal Regulations that states the requirements for eligibility for TDIU Benefits, states the following:

Total disability ratings for compensation may be assigned, where the schedular rating is less than total, when the disabled person is, in the judgment of the rating agency, unable to secure or follow a substantially gainful occupation as a result of service-connected disabilities

Now, as I’ve discussed before on the Veterans Law Blog, the law does not clearly define what substantially gainful occupation is.

But the law DOES define what Substantially Gainful employment IS NOT.

Read the rest of 38 C.F.R. §4.16(a):

Marginal employment shall NOT be considered substantially gainful employment. For purposes of this section, marginal employment generally shall be deemed to exist when a veteran’s earned annual income does not exceed the amount established by the U.S. Department of Commerce, Bureau of the Census, as the poverty threshold for one person. Marginal employment may also be held to exist, on a facts found basis (includes but is not limited to employment in a protected environment such as a family business or sheltered workshop), when earned annual income exceeds the poverty threshold. (emphasis is mine).

So there you have it – the 2 ways that Veteran can earn an income while receiving VA TDIU benefits and stay within the VA unemployability income limits: when the employment is “marginal” and when the employment is “sheltered”.

We’ll look at them in more detail, below.

You might ask “Why” a Veteran is allowed to earn an income in these 2 scenarios, and not exceed the VA unemployability income limits while receiving a 100% TDIU rating.

Truth be told, I have no clue why Congress wrote the laws this way when they wrote them – someday I’ll dig into the legislative history to understand it.

But since Congress allowed it, there is NOTHING wrong with Veterans getting Marginal or Sheltered Employment income while receiving TDIU Benefits.

Said another way – and this is the law the VA does not want you to know – if your alternate source of income is considered marginal or sheltered under VA rules and regulations, then you can earn any amount of income without breaking the VA unemployability income limits.

#1: Marginal Employment & TDIU Benefits.

This is the type of income that many veterans are aware that they can receive even after being granted TDIU Benefits.

Simply go to the US Bureau of Census website, and look up the “poverty threshold for one person”. (Click here to see the historical poverty ratings tables from 1959 – 2015).

You will see that, for 2014, the poverty threshold for one person is $12,316 per year (if you are under 65), or $11,354 (if you are over 65). In most cases, veterans are advised that these poverty thresholds are the VA unemployability income limits.

So, this is the first way that you can earn an income – and continue to receive a 100% TDIU rating – without breaking the VA unemployability income limits: ensure that whatever income you make stays below the poverty thresholds for your family size.

Each year, the VA will ask you to verify your employment (or lack thereof) to determine whether you are eligible to continue to receive TDIU Benefits. They typically require that you use VA Form 21-4140 or 21-4140-1 to do this report.

The VA does cross check 2 databases that I know of: Social Security databases that record your work/income history, and IRS databases that record your family income on your annual tax returns. Word to the wise: if you are telling different income stories to different federal agencies, you are playing with fire, and may even be committing fraud.

If you indicate in this form that your income is higher than the poverty threshold, a proposal to reduce your TDIU benefits will be forthcoming.

It’s one of the few times that the VA acts with a sense of purpose – when they want to STOP paying you.

#2: Sheltered Employment & TDIU Benefits

Another way that Veterans can earn an income while receiving TDIU Benefits – and without breaking the VA unemployability income limits – is by participating in what is called “sheltered employment”.

There are many ways that your income can be considered “sheltered”, but 2 that are clearly identified in the regulation itself:

1) Family business

2) Sheltered Workshop (these are supervised workplaces for adults with a physical and/or mental handicap)

Now, just because you are working for a family business doesn’t mean your job is considered “sheltered employment”. It has to be what the regulation refers to as a “protected environment”.

N.B. – Veterans case law is not 100% clear on what constitutes a “protected environment” or “sheltered employment” or “marginal employment” for TDIU purposes. I strongly encourage that you get legal advice from an accredited VA attorney if you believe that your work is sheltered/marginal/protected so that you do not lose your TDIU benefit because you exceed the VA unemployability income limits.

A protected environment occurs when the employer makes special accommodations to employ and provide an income for a family member or a disabled worker. This happens quite a lot – a family business, to reduce its tax burden or simply to help another family member, pays a disabled Veteran family member an income that they would not otherwise be able to receive.

How can you tell if there is a protected work environment so that you ensure your income does not get flagged as exceeding the VA unemployability income limits?

What kind of questions would you ask, and what kind of evidence would you need?

If you can get answers to the following kinds of questions – typically in an affidavit by the business owner or the executive in charge of hiring/staffing – you will have a much stronger proof of entitlement to TDIU benefits even while earning an income well above the poverty threshold in a sheltered employment situation.

1) Did they employer provide any special accommodations (especially if they are not required to by the Americans With Disabilities Act) to accommodate the employee with disabilities? These accommodations are most commonly adjustments to the work schedule, the work environment, or the work duties.

I have not handled a case yet where a major employer, covered by the Americans With Disabilities Act, provides an accommodation to a 100% disabled Veteran as required by law to do. This is an interesting question as to whether or not the employment could be considered sheltered when the company has a legal obligation to enact accommodations. I am not aware of any VA precedent on this topic – if you do know of a precedential case on this topic, don’t hesitate to let me know!

2) If the employee leaves the company, will the business hire a “similarly situated” person to fill the position (i.e, another worker with a disability)?

There are 3 scenarios here:

Scenario #1: If the business plans to modify the Veteran’s position after he or she leaves so that there are no longer accommodations to the work duties, environment or schedule, then you can make a pretty good argument that the employment is sheltered. Why? Because it appears that the position may have been created or modified just for the disabled Veteran.

Scenario #2: If the business plans on continuing the accommodation, then its a pretty good argument that the position itself – and anyone that holds it – is sheltered employment. (Many employers do this for the tax advantages available to certain types of “sheltered workshops”).

Scenario #3: If the business plans to eliminate the position after the disabled Veteran leaves the job, then it is most likely “sheltered employment”.

None of the above scenarios are absolute: the more evidence you can show that an employer created a job for a 100% disabled Veteran – whether for “feel-good” reasons, tax incentives, or any other reason other than common business reasons, the stronger your case of showing that your position is “sheltered employment” and keeping your additional earnings within the VA unemployability income limits.

3) Is there evidence that another business in the same industry would NOT hire a similarly situated employee, and pay them a similar income, for the same type of work?

What do I mean here?

If your family business pays you $50,000 a year, while allowing you to come in to the job “only on the days you feel up to it”, look to other businesses in the same industry to see if they would pay that same salary to an employee that comes and goes at will.

Where do you get evidence of this sort of thing?

Honestly, you would hire an economist to prepare an expert report on the nature of the employment and whether or not it is sheltered, based on a survey of the particular industry.

This type of expert report can get really expensive, so I would not typically do this unless it was really questionable whether the employment was sheltered or not, and there was a lot riding on the outcome.

Frankly, providing evidence that answers Question #3 is probably a bit “over the top” in most Sheltered Employment claims.

Legal Advice in Sheltered Employment situations.

Be very careful with the Sheltered Employment rules.

They are not frequently applied, many in the VA do NOT know about them, and they can lead to serious consequences if applied incorrectly. The VA fiercely protects what they believe to be the VA unemployability income limits to make sure that veterans do not abuse the benefit.

I’m not telling any details here, but I know of a couple veterans who have been charged with criminal fraud for collecting TDIU benefits while exceeding VA unemployability income limits – they received a (sometimes very small) income and doing nominal work for a family member’s business.

These charges usually will not stick – as the US Attorneys that prosecute these crimes have far less understanding of VA regulations than even most VA raters or Board Hearing Officials. But you’re going to have to pay a criminal defense attorney to make it go away, and the VA ain’t repaying your attorneys fees.

That said, it is ALWAYS BEST to get legal advice – call a VA Accredited attorney and ask for a consultation – if you are considering earning income above the poverty threshold and want to know if it is or is not considered “sheltered employment”.

Chris,

You commented: For purposes of this section, marginal employment generally shall be deemed to exist when a veteran’s earned annual income does not exceed the amount established by the U.S. Department of Commerce, Bureau of the Census, as the poverty threshold for one person.

However, further down you state: So, this is the first way that you can earn an income – and continue to receive a 100% TDIU rating – without breaking the VA unemployability income limits: ensure that whatever income you make stays below the poverty thresholds for your family size.

I have a family size of 2. Does it go by one person/the veteran as you first state? So $12,490 @ the 2019 rate? Or would it go by 2 person family $16,910 @ the 2019 rate?

Generally speaking, the poverty threshold for your family size controls.

Chris

Chris,

I have some questions regarding the VA as an employer and service connected disabilities, do you think you can help or know someone who can?

Eric Pines at PinesFederal.com is an attorney that represents Federal Employees….he may be able to answer your questions.

Tell him Chris Attig sent you.

Chris

Very informative. Clear and cogent – and helpful. Thanks for posting this.

Thanks for the feedback! Glad you found it helpful.

Chris

Chris,

I have been struggling with this question for 10 years (since I have been on IU). The most I have ever earned in one year is about $2800. I have a real estate license and have sold homes of family members or neighbors. Many realtors are reluctant to hire me because I tell them I am restricted as to how much I can earn. My daily activities have been to come into the real estate office once or twice a week, occasionally show a property. mostly though I have conducted my activities (computer work, advertising, phone calls, etc.) in my small home office.

Would working in this situation present a problem if I was to exceed the poverty threshold? What about being an insurance agent (for which I have been licensed for over 30 years though I have earned very little)?

Bill,

I can’t and won’t give legal advice on a particular situation on a blog – I think you ought to talk to an attorney about your situation, though. Email me at support@veteranslawblog.org and I’ll get you some names.

Chris

I just attempted to subscribe (annual) and could not, so I attempted to buy some more books for my upcoming BVA hearing, and your site kept advising me that either my email is incorrect, or my password…….

James,

Please check your email. The solution is there.

Chris

Dear Chris – You seem to have this affinity to hit my VA problem hot buttons.

I have the ‘Sheltered Employment’ problem – in that I own the business. (Valid Fed EIN & DUNS #)

Can one turn down a previously submitted NOD TDIU request, that hasn’t yet been decided by my DRO?

i.e.: (Now @ 70% w/NOD for 2 other major issues awaiting the DRO’s final on those two – and the DRO’s subsequent TDIU package, sent back to me for my submission now awaits my completion. )

Do I need, or how might I be able to get a consult?

Best Regards

Rich

Rich,

Glad that the VeteransLawBlog.org is helping you!

I don’t know that I really understand your question, but I would like to. Would you email me at support@veteranslawblog.org so I can ask some questions to understand what part of the VA process you are trying to better understand.

Chris

I hope to get some good info from you

Ralph,

Thanks for posting! I think you will find that the info on the Veterans Law Blog is more in-depth, more practical, and just all-around “more” than any other blog about Veterans Benefits.

And if it is not, then I hope to hear from you, so that I can make it better!

Chris